For every pattern usually has better-discussed variables to have form stop-losses purchases or take-cash objectives. For instance, within the a triangle pattern, the new breakout section clearly suggests where to enter a trade, as the pattern’s height can be used to guess the potential rate address. Which structured approach facilitate people limitation possible losings and you may optimize growth. After you can be choose the newest Pipe greatest, you can enter into small ranking before a fall. Inside the development phase, the price attacks a top and you may cannot increase after that, appearing fading to shop for momentum. The newest promote rule takes place when the rates vacations beneath the assistance level, usually with more offering frequency.

The last fifth revolution reflects excitement because the buyers rush to find inside the through to the trend ends. Spikes inside graph echo business more-responses determined by ideas such as anxiety, avarice or shock development. For example, negative surges having enough time straight down wicks code stress offering when you’re confident surges with long upper wicks let you know euphoric to find. In both cases, the price try swiftly rejected back to normal profile while the feelings settle-down. If you are a great pennant may seem just like an excellent wedge development otherwise a triangle pattern – explained next parts – it is very important keep in mind that wedges are narrower than simply pennants otherwise triangles.

Candlestick and you will Graph Designs

“Trade regarding the Zone” try Mark Douglas’s https://travelplugkenya.co.ke/2025/09/18/greatest-chart-habits-cheat-layer-to-possess-tech-analysis/ seminal work with change psychology. The ebook concentrates on development a possibility-founded psychology to own change achievement. Douglas examines as to why buyers have a tendency to falter mentally despite good actions and will be offering buildings to conquer mental traps. Key rules is thinking inside the odds, accepting risk, maintaining abuse, and you will understanding the haphazard delivery of victories and you may loss. The ebook will help investors produce the brand new rational discipline expected to own consistent profitability.

The fresh chart notes that it retest since the guaranteeing the brand new trend reversal to the a downside, solidifying confidence on the the newest downtrend assistance. GEECEE Potential Ltd’s rates action could have been to the an extraordinary uptrend in the recent weeks, forming a few higher levels and better downs to the daily chart. Lately, the newest inventory broke away over the prior the-day most of Rs 265, appearing strong bullish impetus. The new megaphone trend is considered a natural extension trend, which have one another upside and you may disadvantage prospective. The newest expanding volatility can make directional bias uncertain, even though traders have a tendency to translate the very last move as the a sign of the brand new most likely breakout direction.

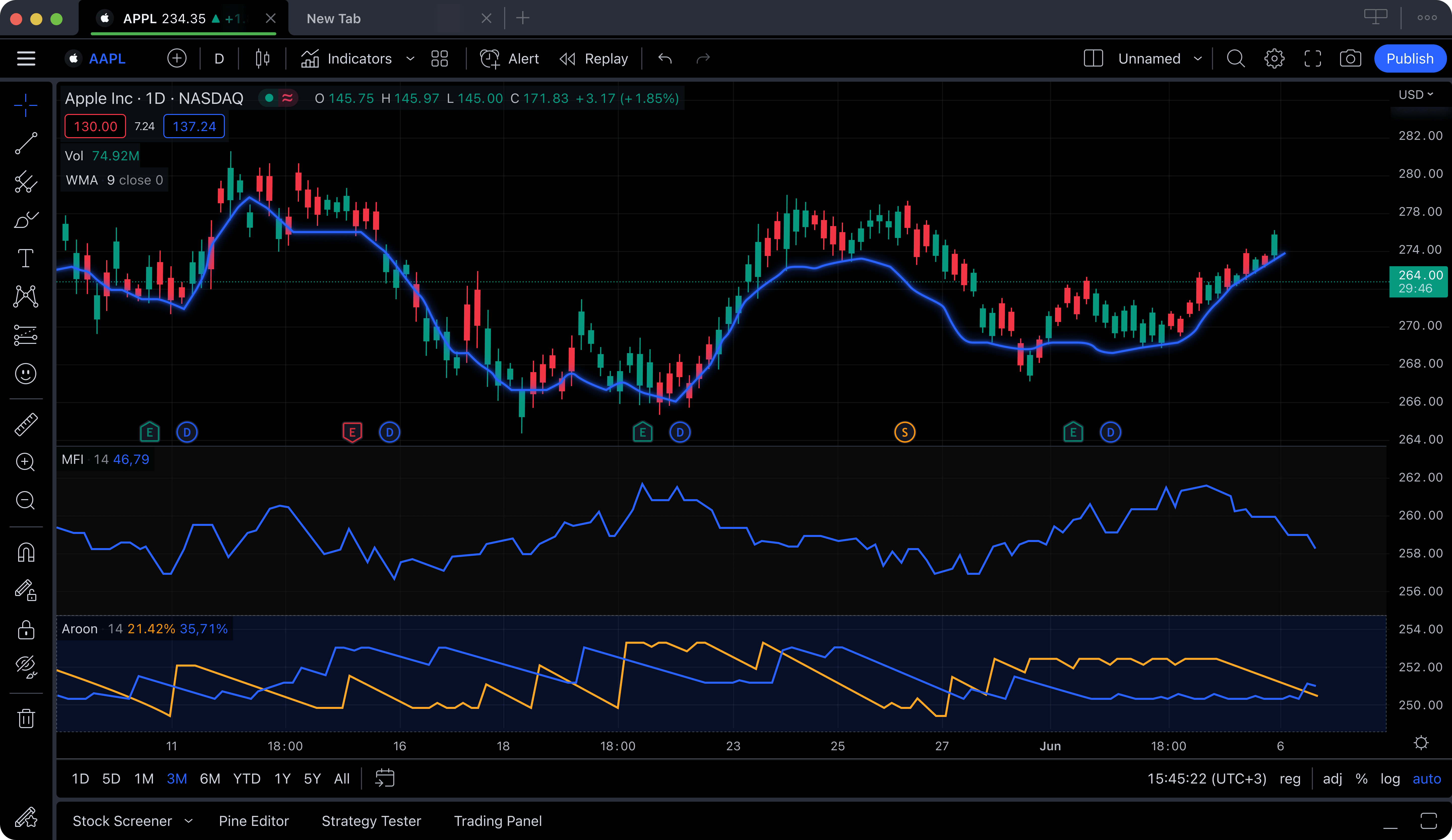

Volume takes on a crucial role inside guaranteeing change models and you will permitting traders gauge the electricity from rate motions. When price step aligns with volume fashion, it includes more powerful change indicators and decreases the chance of not the case outbreaks. Rising Triangles are optimistic extension designs one to imply a keen uptrend is actually gonna continue. They function when price consolidates ranging from a rising trendline (large lows) and you may an apartment opposition top.

Your face and you will shoulders trend try a bearish reverse pattern your can sometimes come across after an uptrend. The fresh development confirms a pattern reverse when the speed vacations less than the new neckline, which is the help level linking the two shoulders. Traders have a tendency to brief industry because the breakout is actually verified, pregnant subsequent speed refuses.

Greatest 20 Chart Models Cheat Layer 100 percent free PDF

- Assistance refers to the top from which an asset’s rate comes to an end falling and you will bounces backup.

- Next, the new inventory actually starts to go up some time however, doesn’t wade too high, carrying out Part dos.

- It versions just after a serious refuse, characterized by 2 or more candlesticks that have almost the same downs, undertaking an excellent “pipe” profile for the chart.

- The brand new Triple Base try a bullish reversal pattern one signals a great possible shift away from an excellent downtrend to help you an uptrend.

- A survey held because of the Thomas Bulkowski inside 2008 examined the newest performance of double finest designs in the stock-exchange.

The new hammer, as an example, are a bullish reverse development that appears just after a downtrend. It appears to be in your chart since the a candlestick having a lengthy straight down wick and you may a tiny looks. The new enough time lower wick implies that there’s solid attempting to sell pressure, but the small system demonstrates consumers managed to force the cost back-up, implying a potential reversal.

However, that’s not all the; additional market conditions, date frames, and you may trading property you will dictate the development of various chart models. In case your dominating development try bullish, which development you may rather have the fresh prominent pattern and you may bust out from effectiveness continue the newest uptrend. At the same time, should your principal marketplace is bearish, it may go for the new downtrend where speed you may use away from support to continue down. Although not, buyers may still need to wait for the speed to-break the support otherwise opposition level, with regards to the development, prior to one exchange decisions. An excellent wedge development is created from the a couple of sloping trendlines hooking up the fresh highs and lows of the candlesticks, moving better together with her since the rates actions. Wedges will likely be renowned because the sometimes an emerging wedge otherwise a good losing wedge.

Symmetric Triangle Trend

Exchange reversal designs add acknowledging these types of habits to learn whenever to leave or get into deals from the maximum date. The reason being all trader have additional enjoy while using graph patterns within their trade. Graph habits will be determined by different aspects for example market standards, some day frames, as well as other monetary assets.The fresh investor have to choose which graph pattern/s works for them. Sometimes, you may need to lookup after dark defects observe exactly what trend is created.

The new development is similar to a downward sloping station for the chart, as in the picture lower than. The fresh Rising Triangle are an incredibly legitimate bullish extension pattern one indicators the potential for an upward breakout. That it development forms while in the an enthusiastic uptrend which can be described as a good horizontal opposition range on top and you can an upward-sloping trendline in the bottom. While the rate consolidates within triangle, the range narrows, as well as the marketplace is get yourself ready for a breakout to your upside. Knowledge these types of habits helps you create told trade choices and you can select when you should get, offer, otherwise hold their ranking. For your major habits, we’ll is a real time example that can explain per trend so you can assist solidify the brand new concepts.

But funds-delivering easily reasons cost to-fall returning to the top of range. Post-surge, the fresh expectation is for the market industry to carry on the previous guidance. Temporary exhaustion is likely following the increase thus laterally consolidation or a pullback possibly occurs through to the development extends then. Immediately after it getaways, the efficacy of buyers is actually forgotten, and you can vendors beginning to speeds their offering ranks. Aggressive and you will high-risk people have a tendency to take small deals at the intimate of one’s malfunction candle and exposure-averse traders have a tendency to await a good retest of this broken neckline on the down date structures and acquire entry patterns.

Stock-exchange Basics

The newest Descending Triangle is a classic bearish continuation trend you to signals the opportunity of the existing downtrend to continue. It is laid out by a horizontal help range in the bottom, in which the speed several times bounces however, doesn’t split lower, and you may a low-sloping trendline on top, where price forms down levels. So it development implies that providers are wearing strength, and you can people are incapable of support the rates from the support, leading to a likely dysfunction. The newest Rising Triangle is one of the most legitimate bullish continuation models, proving one to a current uptrend will remain. It is characterized by a lateral opposition line ahead, where price cannot break through, and you may an ascending-sloping trendline at the end, in which high downs form because the buyers get energy. The new narrowing budget means that tension try strengthening to have a breakout to your upside.

Graph patterns try a reputable kind of trading that can help buyers build direct predictions. Some of the most effective people global having ages out of trade sense have accepted that they are obligated to pay the achievements to chart habits. Put simply, which lingering battle anywhere between consumers and you may providers so to speak offers beginning to your of many graph models your’re also most likely trade today. Graph models setting considering the correspondence between the people and you will vendors, which usually leads to the various chart habits that you can discover in your graph everyday. What makes them job is that they usually reoccur over date, making it possible to backtest her or him and get its probability of rate of success. This type of designs makes it possible to exchange any money partners.

However, other tech analysis is to establish the fresh legitimacy of one’s trend prior to exchange the fresh breakout. Symmetrical triangles setting in the event the rates converges that have a few lower highs and higher troughs. On the example lower than, the entire pattern try bearish, however the symmetrical triangle suggests us there might have been an excellent short-term period of upward reversals. A great rounding bottom graph development is denote a continuation otherwise a good reverse. For instance, while in the an enthusiastic uptrend an asset’s price can get slide right back a little prior to rising once more.